Land ownership and titles are critically important in the Philippines, impacting everything from family wealth to agricultural advancements and urban development schemes. This article gives a thorough look at land titles and ownership rights in the Philippines. It examines the legal structures, kinds of land titles, procedures for getting and transferring land, and how these rights impact Filipino people and residents.

Historical Background

To truly understand the current legal system, you must explore the historical background of land ownership in the Philippines. Colonial rule by Spain and the United States really shook things up when it came to who owned what. During the American colonial period, the Land Registration Act of 1902 was passed. Its designed to establish a system for registering land titles, ensuring secure land tenure, and streamlining land ownership transfers.

Types of Land Titles

1. Torrens Title

The Torrens Title System is the main method used for land registration in the Philippines. It’s like a government guarantee for your land title. This system, which got its start with the Land Registration Act of 1902, is all about making land transfers easier and cutting down on disagreements about who owns what. Once your land title is registered under this system, it’s considered pretty solid—meaning it can’t be easily canceled or taken away unless specific circumstances come up.

2. Original Certificate of Title (OCT)

The Original Certificate of Title is the very first registration you get for a property under the Torrens system. Think of it as the official birth certificate for your land. It proves that your property is officially on the books with the Land Registration Authority (LRA) and that you are the rightful owner.

3. Transfer Certificate of Title (TCT)

Okay, so you have an OCT. Now, anytime you sell or transfer the property, a Transfer Certificate of Title needs to be issued. This TCT is your proof that the new owner is legally entitled to the property. And just like the OCT, it has to be registered with the LRA to make the transfer official.

4. Condominium Certificate of Title (CCT)

This one’s special for condo owners! When a developer splits a building into individual condo units, each unit gets a Condominium Certificate of Title. This shows that you own that specific unit, plus a share of all the common areas, like hallways and the lobby.

5. Other Types of Titles

There are also other types of titles out there. You might see Certificates of Title for government lands or titles granted through special laws like the Comprehensive Agrarian Reform Law. Each of these titles comes with its own set of rules and limitations under Philippine law.

Ownership Rights

In the Philippines, the Civil Code is what mainly governs ownership rights. These rights usually include:

- Right to Possess: As the owner, you have the right to be on your property and use it.

- Right to Use: You can use your property however you want, as long as it’s within the bounds of the law.

- Right to Dispose: This means you can sell, rent out, or otherwise get rid of your property if you choose to.

- Right to Exclude: You have the power to keep others off your property if you don’t want them there.

Remember, these rights aren’t set in stone. There are often restrictions and obligations that come with them, like environmental rules and zoning laws.

To extend on the “Right to Use,” it’s important to understand that this right isn’t a free-for-all. For example, you can’t just decide to build a factory in a residential area, even if you own the land. Zoning laws dictate what types of activities are allowed in certain areas, ensuring that your use of the property doesn’t negatively impact your neighbors or the community.

Similarly, with the “Right to Dispose,” while you can sell your property, you need to ensure you’re following all legal procedures, including paying the appropriate taxes and transferring the title correctly. Failing to do so could lead to legal complications down the road, especially for the buyer.

Now, let’s say you own a piece of land that’s been in your family for generations. You have the right to use that land for farming, building a house, or even starting a business, as long as you comply with local regulations. You also have the right to exclude anyone who tries to trespass on your property. However, you also have the responsibility to maintain your property and prevent it from becoming a nuisance to your neighbors. For instance, you can’t just let your land become a dumping ground for garbage, as that would violate environmental regulations and infringe on the rights of others.

In 2021, the World Bank published a report on land governance in the Philippines. It highlights the need for clearer land administration processes to ensure more equitable access and prevent conflicts. The report emphasizes that robust land governance is crucial for sustainable development and reducing poverty. (World Bank Report on Land Governance in the Philippines)

Acquiring Land Titles

1. Purchase

Buying land is the most common way to get a land title in the Philippines. But, before you hand over your hard-earned cash, make sure the title is legit and doesn’t have any hidden liens or debts attached to it. Do your homework and get a title search done at the Registry of Deeds.

2. Inheritance

Land can also be passed down through inheritance. The laws of inheritance say who gets what, based on whether the deceased person had a will or not. If there’s a will, it’s followed. If not, the Civil Code steps in to decide who gets the property.

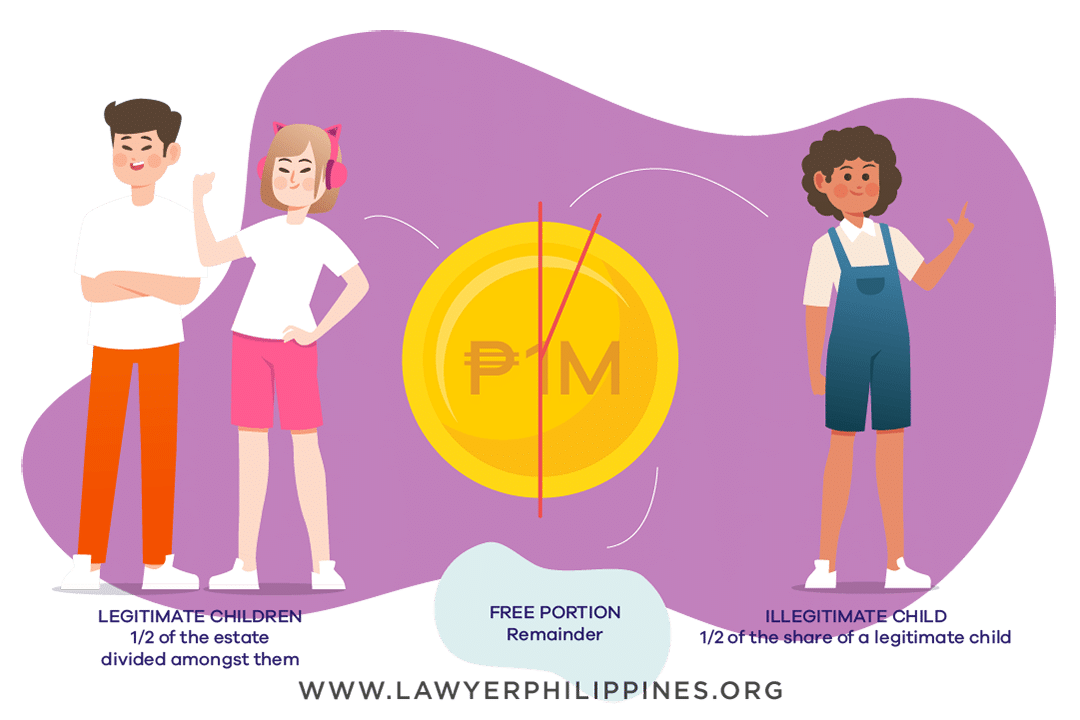

Let’s delve deeper into the concept of inheritance. In the Philippines, inheritance laws are primarily governed by the Civil Code. When someone passes away, their assets, including land, are distributed either according to their will (if they have one) or according to the laws of intestacy (if they don’t). If there’s a will, the deceased person (also known as the testator) can specify exactly how they want their property to be divided among their heirs.

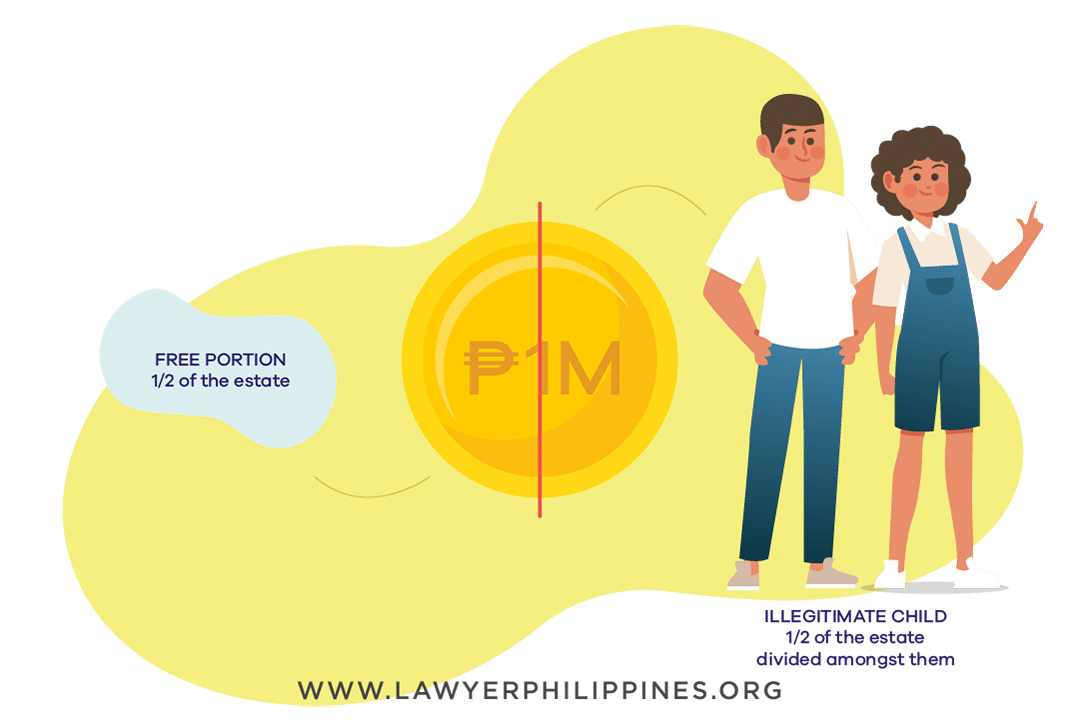

However, there are certain limitations to testamentary freedom. For instance, Philippine law ensures that certain compulsory heirs, such as children and spouses, are entitled to a specific portion of the inheritance, known as the legitime. This means that a testator can’t completely disinherit their children or spouse unless there are specific legal grounds for doing so, such as abandonment or attempting to harm the testator.

Now, what happens if someone dies without a will? In this case, the laws of intestacy come into play. These laws outline a specific order of priority for who inherits the property. Generally, the surviving spouse and children are the first in line to inherit. If there are no children, the parents of the deceased may inherit. If there are no surviving parents, the siblings of the deceased may inherit, and so on.

Navigating inheritance laws can be complex, especially when there are multiple heirs or disputes over the distribution of property. It’s always advisable to seek legal counsel to ensure that the inheritance process is handled correctly and in accordance with Philippine law.

4. Adverse Possession

Believe it or not, you can sometimes gain ownership of land just by living on it for a long time! This is called adverse possession, or “usucapion.” To makethis happen, you usually have to live on the property continuously for at least ten years and act like you own it.

Believe it or not, you can sometimes gain ownership of land just by living on it for a long time! This is called adverse possession, or “usucapion.” To makethis happen, you usually have to live on the property continuously for at least ten years and act like you own it.

Adverse possession, also known as usucapion in the Philippines, is a legal doctrine that allows a person to acquire ownership of land by occupying it openly, continuously, and adversely for a certain period. This means that the person must possess the land in a way that’s visible to everyone, without the owner’s permission, and with the intention of claiming ownership.

5. Government Grants

The government sometimes gives away land to people who qualify, especially through programs like agrarian reform. There are rules and requirements you have to meet to be eligible for these grants.

Transferring Land Titles

Selling land is the most common way to transfer a title. You’ll need a Deed of Sale, which both the buyer and seller have to sign and get notarized. Then, you register the transfer at the Registry of Deeds to update the ownership records.

When transferring land through sale, several crucial steps need to be followed to ensure a smooth and legally sound transaction. First, both the buyer and the seller must agree on the terms of the sale, including the purchase price, the payment method, and the date of transfer. These terms are typically outlined in a Contract to Sell or an Agreement to Purchase.

Next, the seller must provide the buyer with certain documents, such as the Original Certificate of Title or Transfer Certificate of Title, tax declarations, and proof of payment of real property taxes. The buyer should conduct due diligence to verify the authenticity of these documents and to check for any liens or encumbrances on the property.

Once the buyer is satisfied with the documentation, a Deed of Absolute Sale is prepared. This document formally transfers ownership of the property from the seller to the buyer. The Deed of Absolute Sale must be signed by both parties and notarized by a lawyer.

After the Deed of Absolute Sale is notarized, the buyer must pay the applicable taxes, such as capital gains tax (if the seller is a corporation) or creditable withholding tax (if the seller is an individual), documentary stamp tax, and transfer tax. These taxes must be paid to the Bureau of Internal Revenue (BIR) and the local government unit (LGU), respectively.

Finally, the buyer must register the Deed of Absolute Sale with the Registry of Deeds to transfer the title of the property to their name. The buyer will need to submit the Deed of Absolute Sale, along with the other required documents and proof of payment of taxes, to the Registry of Deeds. The Registry of Deeds will then issue a new Transfer Certificate of Title in the buyer’s name.

It’s important to note that transferring land through sale can be complex and time-consuming, especially if there are issues with the documentation or disputes between the parties. It’s always advisable to seek the assistance of a qualified real estate lawyer to ensure that the transaction is handled properly and in accordance with Philippine law.

2. Lease

Renting out land doesn’t transfer ownership. It just gives someone the right to use the land for a certain amount of time. Leases should be written down and registered to protect everyone involved.

Leasing land, while not transferring ownership, grants the lessee (the person renting the land) certain rights to use and possess the property for a specified period in exchange for rent. In the Philippines, leases are governed by the Civil Code, which sets out the basic rules and requirements for these agreements.

A lease agreement should be in writing and should clearly state the terms and conditions of the lease, including the names of the parties, the description of the property, the duration of the lease, the amount of rent, and the responsibilities of each party. It’s also advisable to include provisions for renewal, termination, and any other important terms that the parties agree upon.

The duration of a lease can vary, depending on the agreement between the parties. However, under Philippine law, a lease of agricultural land cannot exceed 25 years, although it can be extended for another 25 years. For other types of land, there’s no specific limit on the duration of the lease, but it’s generally advisable to keep the lease term reasonable.

The lessee has the right to use and possess the property for the duration of the lease, as long as they comply with the terms of the lease agreement. This includes paying the rent on time, maintaining the property in good condition, and not using the property for any illegal or unauthorized purposes.

The lessor (the owner of the land) has the right to receive the rent on time and to inspect the property to ensure that the lessee is complying with the terms of the lease agreement. The lessor also has the right to terminate the lease if the lessee violates any of the terms of the agreement.

To protect their rights, both the lessor and the lessee should register the lease agreement with the Registry of Deeds. This will ensure that the lease is binding on third parties, such as subsequent owners of the property.

3. Mortgage

Landowners can use their titles as collateral for loans. To make the mortgage official, it has to be registered with the Registry of Deeds.

A mortgage agreement must be in writing and must clearly state the terms and conditions of the mortgage, including the names of the parties, the description of the property, the amount of the loan, the interest rate, the repayment schedule, and the remedies for default.

The mortgagor retains ownership of the property but gives the mortgagee a lien on the property. This means that the mortgagee has a legal claim on the property until the loan is fully repaid.

To be valid and enforceable, the mortgage agreement must be registered with the Registry of Deeds. This gives notice to the public that the property is subject to a mortgage and protects the rights of the mortgagee.

If the mortgagor fails to repay the loan as agreed, the mortgagee can initiate foreclosure proceedings. This involves filing a lawsuit in court to obtain a judgment ordering the sale of the property. The property is then sold at a public auction, and the proceeds are used to pay off the outstanding debt. If there are any remaining funds after paying off the debt, they are returned to the mortgagor.

It’s important for both mortgagors and mortgagees to understand their rights and obligations under the mortgage agreement. Mortgagors should make sure they can afford to repay the loan before mortgaging their property, and mortgagees should conduct due diligence to assess the value of the property and the creditworthiness of the borrower.

4. Subdivision and Consolidation

If you’re developing real estate, you might need to divide up (subdivide) or combine (consolidate) properties. This usually requires getting approval from the local government and registering the changes with the land authorities.

Common Legal Issues and Disputes

Land ownership in the Philippines can get messy, leading to all sorts of legal battles. Here are some common problems:

- Boundary Disputes: Neighbors arguing over where their property lines are.

- Title Fraud: Fake or misrepresented land titles. This is a big concern.

- Forced Eviction: People being illegally kicked off their land, especially in cities.

- Inheritance Conflicts: Family members fighting over who gets what after someone dies.

not located within the defined boundaries of the

not located within the defined boundaries of the

the ultimate proof of property ownership under the Torrens Title System, which records the transfer of ownership from one owner to the next. You may not usually need to know the process unless you are a real estate professional, a seller, or a buyer—but once you buy or sell property, understanding how to transfer a land title becomes essential. During a property transaction, all parties—the seller, listing broker, buyer, and buyer’s broker—should clearly agree from the beginning on who will handle the title transfer. If you are the buyer, it’s in your best interest to understand the steps for transferring the land title to your name. You can do the process yourself if you have the time and patience, or you may hire a lawyer, licensed real estate broker, or a title transfer company for a service fee, which varies depending on the property location. For your reference and guidance, here are the:

the ultimate proof of property ownership under the Torrens Title System, which records the transfer of ownership from one owner to the next. You may not usually need to know the process unless you are a real estate professional, a seller, or a buyer—but once you buy or sell property, understanding how to transfer a land title becomes essential. During a property transaction, all parties—the seller, listing broker, buyer, and buyer’s broker—should clearly agree from the beginning on who will handle the title transfer. If you are the buyer, it’s in your best interest to understand the steps for transferring the land title to your name. You can do the process yourself if you have the time and patience, or you may hire a lawyer, licensed real estate broker, or a title transfer company for a service fee, which varies depending on the property location. For your reference and guidance, here are the: